I took a look at my friend’s finances (we’ll call her Samantha,) and after playing with the numbers for a couple of hours, I was able to turn $23,196 worth of student loan debt into what will be a $42,000 asset; a net gain of more than $65,000. This process uses the Income-Based Repayment (IBR) and Public Service Loan Forgiveness (PSLF) programs, and lasts 10 years. Here’s how you do it.

DISCLAIMER: This article uses complex financial strategies that involve principle risk. Each person's financial situation is different, and the methods described below may not be the best fit for your unique situation. Consult a certified financial expert before implementing any of the strategies on this website. This information is provided "as is" and "use at your own risk."

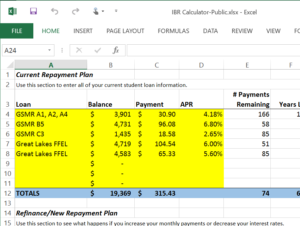

The chart below lists each of Samantha’s student loans along with information provided to us by the lender, such as current balance, monthly payment, and interest rate. Beside that, I have calculated pertinent information, such as the number of payments remaining until the loan is paid off, the number of years remaining until the loan is paid off, the amount of interest she will accumulate, and the total amount she will pay per loan (current balance + interest) from today.

Current Loans

| Loan | Current Balance | Payment | APR | Number of Payments Remaining | Years Left | Total Interest | Total Paid |

|---|---|---|---|---|---|---|---|

| GSMR A1, A2, A4 | $3,901 | $30.90 | 4.18% | 166 | 13.8 | $1,245 | $5,146 |

| GSMR B5 | $4,731 | $96.08 | 6.80% | 58 | 4.8 | $827 | $5,558 |

| GSMR C3 | $1,435 | $18.58 | 2.65% | 85 | 7.0 | $140 | $1,574 |

| Great Lakes FFEL | $4,719 | $104.54 | 6.00% | 51 | 4.3 | $639 | $5,358 |

| Great Lakes FFEL | $4,583 | $65.33 | 5.60% | 85 | 7.1 | $977 | $5,560 |

| TOTAL | $19,369 | $315.43 | 74 | 6.1 | $3,827 | $23,197 |

From the chart above, we can see that the sum of Samantha’s loan balances is currently $19,369, requiring 74 payments of $315.43 over the next 6.1 years to pay off. During this time, her loans will accumulate an additional $3,827 in interest, bringing the total cost of the loans to ~$23,197.

Two simple steps anyone could normally take in this situation would be to 1) refinance the high-interest loans and 2) pay more than the minimum amount required. As shown in the table below, by reducing the interest rate on four out of her five loans and doubling her monthly payment, Samantha will save $2,773 in interest, assuming she qualifies for a 3.38% rate ($23,197 – $20,423 = $2,773). Even refinancing alone while keeping the same monthly payments would save $1,536 in interest (not shown).

Refinanced Loans

| Loan | Current Balance | Payment | APR | Number of Payments Remaining | Years Left | Total Interest | Total Paid |

|---|---|---|---|---|---|---|---|

| GSMR A1, A2, A4 | $3,901 | $61.80 | 3.38% | 69 | 5.8 | $399 | $4,300 |

| GSMR B5 | $4,731 | $192.16 | 3.38% | 25 | 2.1 | $178 | $4,909 |

| GSMR C3 | $1,435 | $37.16 | 2.65% | 40 | 3.4 | $66 | $1,501 |

| Great Lakes FFEL | $4,719 | $209.08 | 3.38% | 23 | 1.9 | $163 | $4,882 |

| Great Lakes FFEL | $4,583 | $130.66 | 3.38% | 37 | 3.1 | $248 | $4,831 |

| TOTAL | $19,369 | $630.86 | 32 | 2.7 | $1,054 | $20,423 |

Samantha works for the office of campus recreation at a local university, and has an adjusted gross income (AGI) of around $20,000. Although her position is not related to any sort of educational benefit, her employer is a 501(c)3 non-profit organization, which qualifies her for the Public Service Loan Forgiveness (PSLF) Program. PSLF allows any person working for government or qualified non-profits to have their federal student loans forgiven after 10 years if they are on Income-Based Repayment (IBR) plans. “Forgiven” means the federal government will pay off any remaining loan balances for you at the end of 10 years.

If we examine any 10-year period for the stock market, we see, on average, an approximate 10% return per year. This means that if we were to invest $100 each month for 10 years, after 10 years we will have invested $12,000, but would expect to have earned another $7,125 through returns (a total of $19,125). Furthermore, if these earnings come in the form of capital gains – which means the stock price appreciates but the companies do not pay dividends (think startups like Tesla as opposed to Utility Companies) – we do not count this as “income” until we sell the assets. You don’t actually earn any money from growth stocks until you sell them (i.e. when the gains are “realized”).

So how do we use this knowledge to our advantage? We leverage the Public Service Loan Forgiveness Program (PSLF) with Income-Based Repayments (IBR) to repay all our debt.

Income-Based Repayment (IBR) plans cap the amount of your monthly payments on your federal student loans at 10-15% of your discretionary income. Discretionary income for this purpose is defined as any amount of your adjusted gross income (AGI) over 150% of the Federal Poverty Level (FPL). The Federal Poverty Level is based on how many persons you have living in your household (persons = dependents such as kids, your spouse, your elderly grandmother, etc. It does not include roommates.) If you’re a single individual with no kids living in the continental United States, your 2017 Federal Poverty Level (FPL) is $12,060; 150% of that is $18,090. The Federal Poverty Level (FPL) increases at the rate of inflation, usually around 2% per year. The table below lists 2017 federal poverty levels by household size for people living in the continental US (Hawaii and Alaska have slightly higher FPLs):

Federal Poverty Levels

| Persons in Household | 2017 Federal Poverty Level | 150% FPL |

|---|---|---|

| 1 | $12,060 | $18,090 |

| 2 | $16,240 | $24,360 |

| 3 | $20,420 | $30,630 |

| 4 | $24,600 | $36,900 |

| 5 | $28,780 | $43,170 |

| 6 | $32,960 | $49,440 |

| 7 | $37,140 | $55,710 |

| 8 | $41,320 | $61,980 |

A single individual with an adjusted gross income (AGI) of $18,090 or less in 2017 has no discretionary income, and therefore will have student loan payments of $0 under Income-Based Repayment (IBR). As you earn more, your monthly student loan payment amount will rise by 10-15% of the amount over your FPL. The table below shows student loan payments at various levels of income. A single individual with an AGI of $40,000 a year will have payments between $182.58 and $279.88 per month; someone with an AGI of $50,000 will have payments between $265.92 and $398.88 per month. Whether you pay 10% of your discretionary income or 15% depends on the type of federal loan you have and when you opened it, but we are not concerned about this for our plan.

Monthly Loan Payments

| Adjusted Gross Income (AGI) | Annual Discretionary Income (ADI) | Monthly Discretionary Income (MDI) | Monthly Loan Payments at 10% of Discretionary Income | Monthly Loan Payments at 15% of Discretionary Income |

|---|---|---|---|---|

| $15,000 | ($3,090) | ($257.50) | $0 | $0 |

| $17,500 | ($590) | ($49.17) | $0 | $0 |

| $18,090 | $0 | $0 | $0 | $0 |

| $20,000 | $1,910 | $159.17 | $15.92 | $23.88 |

| $22,500 | $4,410 | $367.50 | $36.75 | $55.13 |

| $25,000 | $6,910 | $575.83 | $57.58 | $86.38 |

| $30,000 | $11,910 | $992.50 | $99.25 | $148.88 |

| $35,000 | $16,910 | $1,409.17 | $140.92 | $211.38 |

| $40,000 | $21,910 | $1,825.83 | $185.58 | $273.88 |

| $45,000 | $26,910 | $2,242.50 | $224.25 | $336.38 |

| $50,000 | $31,910 | $2,659.17 | $265.95 | $398.88 |

| AGI - 150%FPL | ADI / 12 | MDI * 10% | MDI * 15% |

While the monthly payments on your student loans may be reduced or eliminated, it is important to understand that the interest on them still accumulates. Despite making monthly payments of $23.88, the balances on Samantha’s loans will increase to $29,981.77 after 10 years (see table below). That’s because the monthly interest accumulation on her loans is more than her payment of $23.88. Without substantially higher monthly payments, these loans will never be paid off. So how does Income-Based Repayment (IBR) work in our favor?

Loan Payments on Income Based Repayment (IBR)

| Loan | Balance | Payment | APR | # Payments Remaining | Years Left | Bal After 10 Yr |

|---|---|---|---|---|---|---|

| GSMR A1, A2, A4 | $3,901 | $4.78 | 4.184% | 120 | 10 | $5,213 |

| GSMR B5 | $4,731 | $4.78 | 6.8% | 120 | 10 | $8,503 |

| GSMR C3 | $1,435 | $4.78 | 2.65% | 120 | 10 | $1,213 |

| Great Lakes FFEL | $4,719 | $4.77 | 6% | 120 | 10 | $7,804 |

| Great Lakes FFEL | $4,583 | $4.77 | 5.6% | 120 | 10 | $7,248 |

| TOTAL | $19,369 | $23.88 | 120 | 10 | $29,982 |

Earlier I stated that by putting $100 per month into an investment fund with a 10% expected rate of return, you can reasonably expect to have ~$19,125 after 10 years. We also know over 10 years, our loan balances will balloon to $29,982 under IBR. So what we want to do is figure out how much we need to put away in order to end up with $29,982 after a 10-year period.

The following chart shows total returns for an investment over a 10-year period at different interest rates. For example, if you put $275 per month into an investment that yields a 10% return, you will have $52,594 in 10 years; $200 per month at 8% will yield $34,768; and so forth.

Returns on an Investment Over 10 Years

| Monthly Contribution | 5% | 6% | 7% | 8% | 9% | 10% |

|---|---|---|---|---|---|---|

| $291 | $43,940 | $46,046 | $48,267 | $50,608 | $53,076 | $55,676 |

| $275 | $41,507 | $43,497 | $45,594 | $47,806 | $50,137 | $52,594 |

| $250 | $37,734 | $39,542 | $41,449 | $43,460 | $45,579 | $47,812 |

| $225 | $33,960 | $35,588 | $37,304 | $39,114 | $41,021 | $43,031 |

| $200 | $30,187 | $31,634 | $33,159 | $34,768 | $36,463 | $38,250 |

| $190 | $28,678 | $30,052 | $31,502 | $33,029 | $34,640 | $36,337 |

| $175 | $26,414 | $27,680 | $29,015 | $30,422 | $31,905 | $33,469 |

| $150 | $22,640 | $23,725 | $24,870 | $26,076 | $27,347 | $28,687 |

As anyone that sells financial products will tell you, historical performance does not guarantee future returns. Just because the average gain for a particular mutual fund over the past 10 years was 10%, doesn’t mean that will happen for the following 10 years (in fact, you could lose all of your investment, including principle). As someone that likes to plan for the underwhelming results, I assumed that our investment grew at 6% per year. This means that in order to earn at least $29,982 after 10 years, we need to invest $190 per month for 10 years into a growth fund that appreciates 6% per year (according to our table above). If our fund performs on target, we’ll have $30,052 after 10 years. If it does better, great, but I wouldn’t plan for this to happen; always plan to be underwhelmed.

Let’s recap:

- Samantha has $20,000 worth of federal student loans, which she currently pays $315/mo towards.

- Samantha earns $20,000 per year working for a non-profit. Under an IBR plan, her loan payments will be ~$24/mo.

- Samantha’s loans will be forgiven under the IBR/PSLF Program after 10 years.

- By paying $24/mo towards her student loans, Samantha’s loan balances will balloon to ~$29,982 after 10 years

- Putting $190/mo into an investment that appreciates 6% per year will result in a balance of $30,052 after a 10-year period.

If it isn’t clear what we’re doing, we’re taking the money that we would normal pay towards student loans and redirecting them into an investment vehicle that will appreciate at 6% per year. At the end of 10-years, our student loans will be paid off by the federal government, but the investment will still be ours to keep. The practical effect of this is as follows:

Samantha’s monthly payments will be reduced from $315/mo to $214/mo, putting an additional $101 per month of cash into her pocket. The $214 per month is divided between a $190 investment contribution and a $24 student loan payment. The value of the extra cash at the end of 10 years is $12,120 ($100/mo * 120 months).

At the end of 10 years, the Public Service Loan Forgiveness (PSLF) Program will pay off the $29,982 balance on her student loans. Samantha should also have ~$30,052 sitting in an investment account, which she can now cash out. When this is added to the $12,120 in cash she’s saved from lower monthly payments and the original loan that has been forgiven ($23,197), she will have experienced a net gain of more than $65,000!

There are several assumptions made in order for this to work:

- The investment vehicle needs to be something that is taxed as capital gains. Earning dividends results in ordinary taxable income that cannot be deferred. Ordinary income means a higher adjusted gross income, which means higher student loan payments. Growth-focused investments with low dividend yields (or Roth IRAs) will not have this problem.

- Samantha needs to maintain an adjusted gross income at or near 150% of the federal poverty level ($18,090 in 2017) for 10 years.

- Samantha needs to work for a qualified employer and and make 120 loan payments while on the Income-Based Repayment plan. Neither of these have to be continuous, although both conditions must be true at the time of the payment, or else it doesn’t count towards Public Service Loan Forgiveness (PSLF).

What happens if Samantha makes more money (resulting in a higher AGI)?

Even when your salary grows, there are still a number of ways to reduce your adjusted gross income (AGI). The simplest and most common method is through contributions to qualified retirement accounts. Contributions to a 401k, 403b, or 457 supplemental plan are “above the line” tax deductions, meaning they lower your AGI. Samantha could potentially earn up to $54,090, contribute $18,000/year to her 403b and $18,000/year to her 457 (assuming her employer offers these), and still pay nothing on her student loan payments. ($54k Income – $18k 403b Contribution – $18k 457 Contribution = $18,090 AGI, which is 150% FPL, which means no student loan payments).

Other above-the-line tax deductions include:

- Student loan interest

- Business mileage

- Job-related moving expenses

- Alimony

- Early withdrawal penalties for CDs and savings accounts

- Qualified tuition and fees

Even if you make $54k/yr, you’ll still be living like a poor person until the 10 years is up. If you only have $20k in student loans, and you start your career making $54k, I would advise you to just pay off the debt like a normal person (maybe refinance and increase your monthly payment amount). However, if you’re 8 years into this plan and your salary jumps to $54k, reduce your AGI by maximizing your retirement contributions and just stick it out for the remaining two years. You can also try negotiating non-taxable, non-salary compensation increases with your employer, such as additional vacation time.

What happens if Samantha wants to change jobs?

If Samantha changes jobs from one qualified employer to another (e.g. one non-profit to another non-profit), she’ll need to complete and submit a new Employment Certification form, but other than that, not much will change. Her loan payments will continue to qualify, and she’ll keep credit for all of her previous payments.

If Samantha decides to leave government/non-profit and work in the private sector, she’ll no longer qualify for PSLF payments. We’ve attempted to mitigate this scenario by putting money in an investment vehicle that grows at a rate equal to her student loans. If for example, after 5 years, Samantha quits her job to go elsewhere, her student loan balances will have increased to $23,457. If she’s kept up with her investment contributions and those investments have hit our target growth of 6%, the value of her portfolio should be around $12,850 (calculations for these numbers are not shown). She can sell this to pay off half her loans, and then make payments as she normally would to pay off her loans. Note that she will need to pay capital gains taxes (usually 10-15%) on the amount her investments have appreciated.

One risk associated with this is assuming a 6% return on your investment. While investments historically average a 10% return per year over long periods of time, you can still have years with negative growth. For example, take a look at this graph:

Although the average return may be 10% per year, this may be the result of being down 30% in year 1, and up 30% in years 2 and 3, and so forth. Regular contributions spread out over a long period of time greatly reduce this risk, but the fact remains that if you suddenly need to pull out your money, you risk doing so in a “down year”. This article does a good job at explaining this concept. You can also read about Dollar Cost Averaging, which is one way we have mitigated this problem.

Would you recommend Income-Based Repayment (IBR) and loan forgiveness for employees of for-profit companies?

It depends on your unique circumstances. I would say probably not, but it might work if your loans are astronomical. The problem is that forgiveness programs for for-profit employees take 20-25 years to take effect. This means that you will need to earn an adjusted gross income at 150% of the federal poverty level for 20-25 years, something I think most people are not willing to do (someone graduating at 21 will be 46 by the time their loans are forgiven). On the other hand, I think it’s reasonable to get a job as a teacher or join the Peace Corps or do something similar for 10 years in your twenties, and then use your investment to put a down-payment on a house, start a business, or other invest into other income-generating assets when you’re 30.

What do you recommend for people that have a lot of non-federal student loans?

The Public Service Loan Forgiveness (PSLF) program only applies to specific types of federal student loans. The first thing you should do with all private loans is to refinance them to lower interest rates. This will generally save you a lot of money. Some of the lenders that do this include Sofi, DRB Financial, and Common Bond. Be careful though – refinancing federal student loans will make those loans ineligible for income-based repayment.

The next thing you can do is to increase your monthly payments towards high interest non-federal student loans. By increasing the amount of your payment each month, you are in effect borrowing money for a shorter amount of time, which means you pay less in interest. Cumulatively, this can save you thousands or even tens of thousands of dollars in interest charges.

Also be aware that private loans payments have no effect on your federal student loan payments. The sum of your federal student loan payments will be 10-15% of your discretionary income, regardless of what your non-federal student loan payments are.

If you have massive amounts of student debt that you think will not be repayable, you may want to consult a bankruptcy attorney. Bankruptcy can discharge your debt, but the process will ruin your credit for the next 7-10 years. It’s not something I’m too familiar with but I know that it is an option, and for some people that have hundreds of thousands of dollars in debt and a job that only pays $30,000/yr, it might be a good idea to consult an attorney.

What fund should I invest in?

I’m not the right person to ask here, because I’m not a certified financial advisor, but I would imagine something like the Vanguard Small-Cap Growth ETF (VBK) would be appropriate. The key is to invest in a well-diversified fund targeted at equity appreciation and not dividends (you want growth stocks, not value). Any income earned through dividend payments will be considered ordinary income, and added to your adjusted gross income, which will cause your monthly student loan payments to increase. The Vanguard Growth ETF (VUG) is a little less risky, but you’d earn more as dividend income.

Another option to consider is putting your first $5,500/yr into a ROTH IRA, which would allow you to invest in any kind of fund and grow it tax-free. You wouldn’t be able to cash out any gains until retirement (unless you pay a penalty,) but you could cash out any principle put in there penalty- and tax-free. You would also have the added benefit of more funds with greater diversification and/or less risk. Speak with a certified financial advisor and ask them what the best option is for your situation.

What other risks are there?

There are a few risks that I haven’t really touched upon:

- The federal government could end or significantly alter the Public Service Loan Forgiveness (PSLF) program in some way that makes this plan no longer work. The Trump administration has talked about modifying PSLF, but hasn’t given any details on what he plans to do. I am not an attorney, but I would think that if you sign up for income-based repayment (IBR) before they change it, they would need to honor the terms of their original agreement. But if you have concerns about this, you should ask an attorney.

- The economy could crash and burn. The worst case scenario would be that your investments are essentially worth nothing, you lose your job because the economy is in the gutter, and because you are no longer working for a non-profit, your PSLF discharge date is pushed back. If this happens, I would probably hold onto your investments, wait for the economy to recover, and then sell them when you’re ready. This is a “what-if” you’ll want plan for with your financial advisor, along with plans for if you change jobs, suddenly inherit lots of money, etc…

- Any other risks I may have missed. I’m not a lawyer, certified financial planner, or certified public accountant. This plan was developed from knowledge I’ve gained from studying the tax code while running my business, and through learning about investment products over the years. Someone that is certified in this arena of expertise and does it every day is going to have a greater understanding of the specific financial products that will work best for you. Many employers even offer financial planning services for free – talk to your human resources department and see if they have someone you can meet with. Just make sure whomever you speak with has a fiduciary duty to act in your best interest.

What else should I know?

You need to apply for Public Service Loan Forgiveness (PSLF) at the end of your term (it doesn’t happen automatically). See this website for more information.

You should complete and submit the Employment Certification form as soon as you switch to IBR. Too many borrowers wait to submit this important form until they have been in repayment for several years, at which point they learn that they have not been making qualifying payments. In order to ensure you’re on track to receive forgiveness, you should continue to submit this form both annually and every time you switch employers.

You should also read the Federal Student Aid website, which has lots of answers to common questions, such as what happens if you switch employers, if you only work 9 months out of the year, or what qualifies as “full time” employment.

There are specific loan forgiveness programs for teachers, some of which forgive after 5 years. If you’re a teacher, you may want to look into these instead of the generic 10-year Public Service Loan Forgiveness (PSLF) program.

You’ll be living like a (somewhat) broke person for 10 years. You’ll want to create a budget for an income of ~$20,000 (or whatever you decide), which includes the modified student loan payment + investment contribution, rent, car payment, cell phone, insurance, food, entertainment, etc… can you afford to do that? You may need to get creative or find ways to reduce your expenses. If you do something like PeaceCorps, most of your food and housing will be taken care of for you, and your time with them will count towards your Public Service Loan Forgiveness (PSLF) contributions.

If you get married, your AGI income will be the combined income of you and your spouse. If your spouse earns a lot more money, it will affect your payment terms under IBR. Be aware of the financial ramifications if you plan on getting married in the next 10 years.

You may need to wait until the tax year following the discharge of your loans through PSLF to cash out your investment. In the year you sell your investment, your AGI will be much higher, and I don’t know if the loan provider would come back and say that you weren’t paying enough towards your student loans that year. While I think this scenario is unlikely, I’d still recommend looking into it and reading the exact terms of the forgiveness.

Download the spreadsheet

If you would like to download the spreadsheet I used to calculate everything, enter your email address below to have it sent to you.

Please subscribe

If you’ve found this information helpful, please share this and subscribe to my email list and follow me on social networks. I intend to write a lot more on these subjects in the coming months ahead, and will use my email list to communicate when new articles are published.

Affiliate Disclaimer

This article contains affiliate links. If you sign up for products and services through one of our affiliates, we will earn a commission.